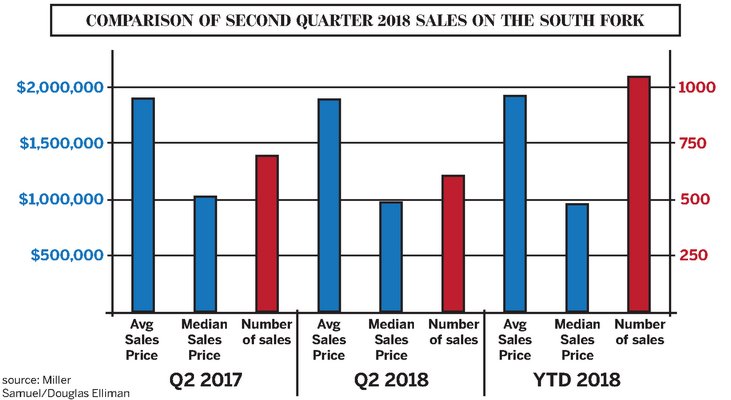

At first glance, the South Fork real estate market statistics for the second quarter of 2018 look grim: Key metrics by Miller Samuel Inc., a real estate appraisers and consultant firm for Douglas Elliman, indicate the median sales price declining by 5.3 percent, the average sales price down 0.2 percent, and the number of sales reduced by 12.8 percent when compared to last year’s second quarter.

But the declines are nothing to lose sleep over, and there are other metrics to be happy about, including significant growth in the $5 million to $8 million range.

“There is a downward correction in Hamptons market,” said Carl Benincasa, a Douglas Elliman regional vice president of sales. “Buyers are always aware of it before sellers. But now the sellers are finally figuring out where buyers are and they are making the adjustments they need to meet them. That’s why you are seeing prices drop; that’s why you are seeing houses are being sold faster; that’s why you are seeing listing discounts go down: because sellers are pricing their homes more reasonably.”

Mr. Benincasa said he sees the second quarter as a transition period when buyers and sellers are meeting more in the middle, and there will be many transactions in the third quarter. The transition, however, is not always easy.

“One of the characteristics of the high-end housing markets around the region, whether we are talking about New York City or the outlying suburbs, is a sales decline,” said Jonathan Miller, the president and CEO of Miller Samuel, “and the Hamptons is no different.”

Mr. Miller said one of the key observations was the decline in sales activity of homes in the $1 million to $5 million price range—or a “soft middle”—which made up a bulk of the quarter’s loss.

“But the 10-year quarterly average is 474 homes sold—Q2 2018 was 601; Q1 2018 was 441; Q2 2017 was 689—sales are not necessarily low in the Hamptons. The Hamptons is known for the luxury market. While the overall inventory of the Hamptons is steady or declining, the actual inventory in the luxury market, meaning the top 10 percent, jumped and is continuing to rise.”

But on either side of the soft middle, brokerages saw significant growth.

“I see the needle being kicked up,” said Judi Desiderio, the CEO of Town & Country, noting that she has seen the $5 million to $8 million range shoot up 60 percent. “I want to see what happens next quarter—but I think that price range is going to feel very comfortable and moving in the right direction.”

Douglas Elliman’s report counted the number of sales over $5 million at 49, which would tie it for the third highest quarterly sales total in 14 years. The fourth quarter of 2015 is first in that price range at 62.

Ms. Desiderio attributed the surge of buyers in that range to one demographic: baby boomers.

“I think the well-established but aging baby boomers are getting ready to retire and so many are in New York, New Jersey, Connecticut and Long Island, and have always vacationed here,” she said. “So, maybe it’s time that they are trading up, selling their ’80s house in the Hamptons and trading up to something where they can enjoy the fruits of their labor in retirement.”

Ms. Desiderio noted that the market loses steam in the $12 million to $15 million range, and the over $20 million range has been slim with only one sale. That’s contrary to the first quarter report, which had four sales for more than $20 million. “The third quarter is going to tell me whether the over $20 millions is actually falling off a little bit,” Ms. Desiderio said. “But we are in such a geopolitical centrifuge that anything could happen.”

After 37 years selling real estate on the South Fork, Ms. Desiderio said she has never seen a time that has had the high-end market this strained, “except maybe after 9/11.” She pointed to a grim outlook if “the heads of countries continue to posture the way that we have seen, like the way that the U.S. has crossed sabers with Iran and Russia; it makes everyone feel like they are not in control. … We are a luxury item. They don’t always have to have what we are selling. They have silly money. When you have homes trading at more than $20 million, that buyer has artwork that cost more than the house—they could go anywhere.”

Brown Harris Stevens of the Hamptons tallied 15 sales over $10 million.

Robert M. Nelson, a BHS senior managing director, said that in the over $5 million category there were 53 sales, but BHS could include only 34 of those sales in its second quarter report.

“Suffolk County is notoriously slow at recording and that means we are missing a large segment of our report, which has to report closings,” Mr. Nelson said. “We saw a lot of closings happening at the end of the second quarter that have not been recorded yet, which cannot be reflected on yet.”

For that reason, John F. Wines, a licensed real estate broker in the Southampton office of Saunders & Associates, said Saunders is not prepared to release its second quarter report yet.

“The information that is publicly available today, however, is not complete and possibly does not present an accurate picture,” Mr. Wines said. “In a market where a handful of transactions can have such a significant impact, we believe it is prudent to wait until as many of the relevant sales as possible have been reported before trying to do an analysis of the data. To do anything less could be misleading.”

Meanwhile, Mr. Nelson said the lackluster quarter was a result of a lot of people coming out in the late winter and early spring after a blustery cold winter to view houses, get into contract and close in June before the summer. “But we won’t see the latter half of those numbers recorded until the third quarter.”

The fall also happens to be the season when most people look to upgrade from renting to buying a South Fork home.

“They’ve enjoyed the summer beach and activities and they are looking to purchase for the following year,” he said. With that in mind, Mr. Nelson forecast a strong third quarter—as it will incorporate sales that were closing during the previous period—despite the second quarter signaling an increase in home prices, too.

Nearly 70 percent of all sales on the South Fork were under $2 million, according to BHS. “This demographic, if I had to speculate, are under 40 with some connection possibly from the city who may have rented or vacationed here before. This is their starter, second home,” Mr. Nelson said.

Staggering statistics came out of East Hampton Village, with an average sales price at $6 million, according to BHS.

“People are split between biting the bullet and spending more money in the villages for the walkable amenities, and low density but more affordable estates,” Mr. Nelson said. “That’s why prices continue to rise.”

Contrary to second-quarter reports by BHS and Douglas Elliman, Corcoran Group Real Estate found that sales activity and volume were up across the board on the South Fork. “There is a lot of activity on the very high end, which has caused the volume and average sales price to increase dramatically—up 13 percent and 15 percent year-over-year,” said Ernest Cervi, Corcoran’s East End executive managing director.

Sales price above the $5 million mark increased more than 50 percent in East Hampton, Bridgehampton, Sagaponack and Amagansett, according to the Corcoran report. Sales jumped 24 percent in Southampton, 50 percent in Water Mill and 58 percent in East Hampton Village. The west-of-the-canal market was steady with homes in under $1 million making up more than 70 percent of the market share. Homes in the $1 million to $2 million range grew to 16 percent of the market.

“The small shift in percentages are a result of the inventory that was purchased,” Mr. Cervi said. “I wouldn’t call it a trend. Overall, I think the market is strong. I think it may have been a bit quiet up to this point. But when we see activity on the very high end in a given quarter, that usually indicates activity at other price points for our market.”

Mr. Cervi said he has seen many renters convert to buyers already this season after the dramatic increase in number of rentals, especially seasonal rentals, this year.