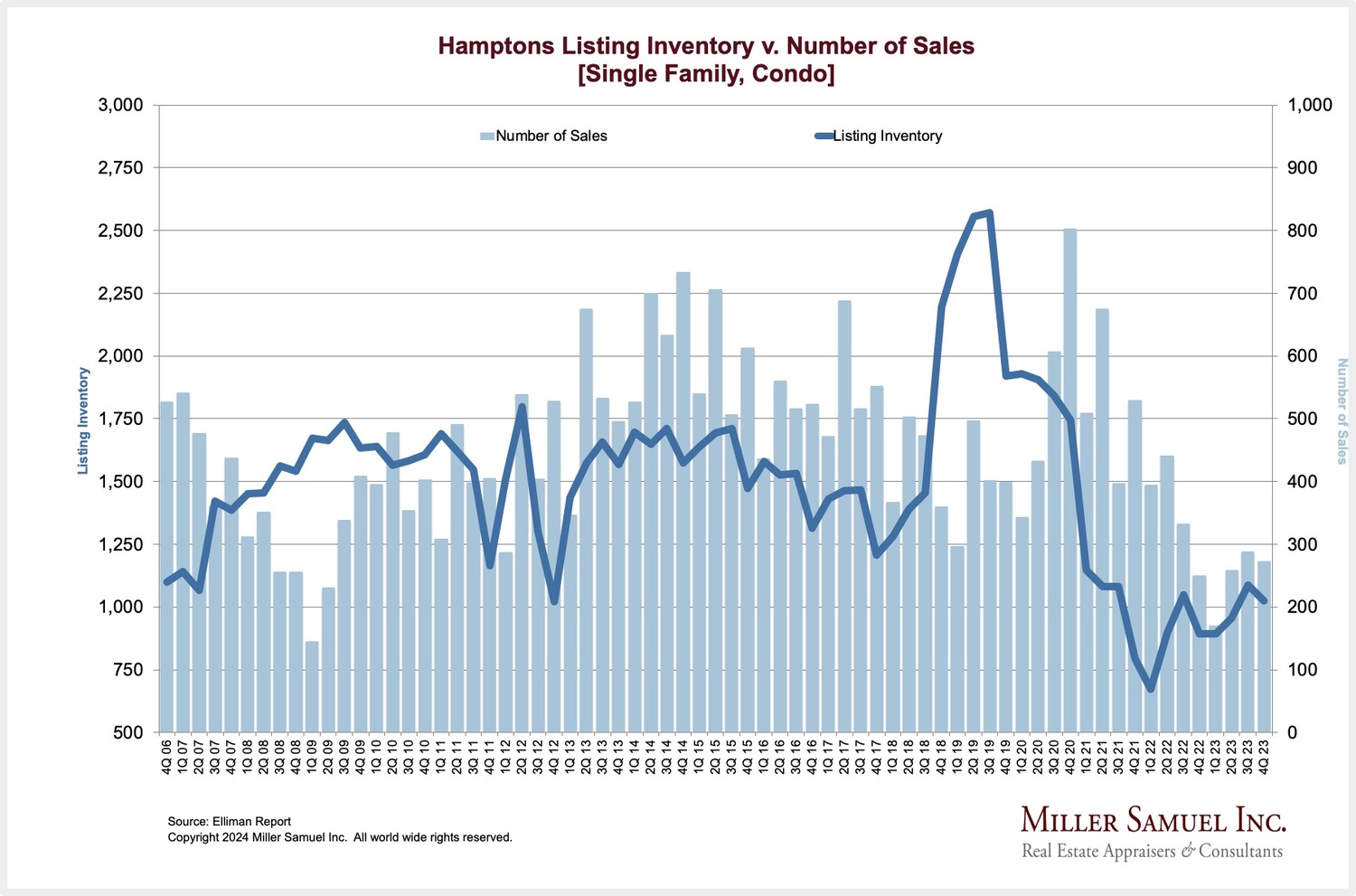

The number of homes sold in the Hamptons in the fourth quarter of 2023 ticked up 8.8 percent compared to a year prior, the first time in eight quarters that the market experienced a year-over-year sales increase.

Though the long-awaited sales increase is good news for the state of the market, the number of sales was still lackluster compared to the 10-year quarterly average. Market experts attribute the low sales figures mainly to the persistently and stubbornly low inventory of homes for sale after the pandemic-driven buying frenzy of 2020 and 2021 absorbed much of what had been on the market. The slim pickings, especially among more modestly priced and mid-range homes, contributed to the median sales price skyrocketing 45 percent to $1.85 million, a record high.

Hamptons market experts weighed in on the fourth-quarter reports and their expectations for the year ahead, including strong prices, more sales and a robust rental market.

A Tough Year To Navigate

Hesitation and uncertainty marked the Hamptons real estate market in 2023.

“2023 was a tough year to navigate,” said Todd Bourgard, the CEO of Long Island, the Hamptons and the North Fork for Douglas Elliman. “Putting deals together was more difficult than ever before. And our agents really navigated through those deals beautifully. They did a great job putting deals together when everything seemed to be just a little bit more difficult.”

The difficulty came in decision making, something both homeowners and homebuyers struggled with. Owners took time to decide to list, and buyers waited for a market adjustment that never came.

“There was a bigger thought process in 2023 with both buyers and sellers,” Bougard said. He lauded agents for getting listings to the market by explaining to homeowners what their homes are worth.

“It was a time where you just had to let people decide for themselves,” he added. “You can’t talk somebody into that. This is their biggest asset or their biggest purchase. So you let it take its own course.”

How Interest Rates Move the Market

The Federal Reserve has forecast it will cut the federal funds rates by 75 basis points in 2024, bringing the target rate from 5.5 percent down to 4.75 percent by year’s end. In turn, 30-year mortgage rates could slip to under 6 percent.

Bourgard expects that when rates fall to any number that starts with a 5, there will be a generous uptick in sales.

The Fed began hiking rates in March 2022 to tame inflation, which has cooled significantly. Somewhat miraculously, the hikes did not cause a recession or a spike in unemployment, though the Fed is planning the rate cuts to ensure the economy continues to hum along.

“I can't remember being in a period of time where housing was anticipating rate cuts when unemployment was below 4 percent,” said Jonathan Miller, the president and CEO of Miller Samuel Inc., a real estate appraisal and consulting firm. “It’s like the perfect storm for housing in 2024. Granted, it’s not going to be a boom or frenzy, like we had during the pandemic, but it’s going to be a year of higher transactions.”

Miller watched the Hamptons market closely as the author of the Elliman Report, a quarterly market report put out by Douglas Elliman. Last year he began calling 2023 “The Year of Disappointment,” as sellers were not going to attain 2021 prices and buyers would not see any big discounts. Now he’s calling 2024 “The Year of Incremental Change (The Year of Less Disappointment).”

He explained that as rates go down, inventory will come onto the market incrementally and demand will rise incrementally, so home prices will remain the same or rise. Ultimately, he believes, the inventory level will be a wash.

While rate cuts are clearly a motivating factor for buyers, they also can motivate homeowners to become homesellers. Homeowners who bought or refinanced at a remarkably low interest rate during the pandemic will be reluctant to sell those homes only to pay a much higher mortgage rate to live elsewhere. But the more rates fall, the less of an issue that is.

After reaching a high of about 8 percent, the average 30-year fixed mortgage rate has receded to about 6.7 percent.

“They’ve already fallen down without the Fed even doing anything,” Miller said. “The rates are down over like a percent, and the Fed hasn’t even cut yet.”

He said there has already been a noticeable uptick in sales activity across the region and the country in response to the Fed’s announcement that rate cuts are coming.

“Many of the brokerage community will say that the high end doesn’t rely on interest rates, and that’s true to a certain extent,” Miller said. “But they also watch the financial markets very closely as a whole, and Fed policy clearly impacts the performance of the financial markets.”

Barring a “black swan” event like COVID happening, Miller anticipates interest rates will be lower a year from now and even lower a year after that. But that doesn’t necessarily equal a break for prospective homebuyers.

“In those two years, prices will be higher because inventory will remain a challenge,” he said.

In many ways it makes a lot of sense for those who are on the fence about buying to take action sooner than later because if they wait for rates to fall, prices will be higher, according to Miller.

Judi Desiderio, the founder and CEO of Town & Country Real Estate, is skeptical that rate cuts will actually lead homeowners who locked in low interest rates to put those houses on the market now.

“I don’t know that a lot of those people are going to ditch their homes,” she said. “These homes that they bought are their safe havens.”

She believes that what will really help to bump up available inventory is lifestyle changes.

“There are 10,000 Baby Boomers retiring every day,” she noted. “They go to Florida, they go to the Carolinas, they go to wherever their grandchildren are. That’s going to be what pushes the inventory up, and when you push the inventory up, then you push the number of sales up.”

Miller observed that people’s lives keep moving forward, and they become less locked in to the rate they attained two or three years ago. Giving an admitted exaggerated example, he said someone who bought a cottage three years ago and had triplets since then will be motivated to sell and trade up regardless of what the interest rates are.

High End Skews the Numbers

Miller splits Hamptons sales activities into three tranches: under $1 million, between $1 million and $5 million, and over $5 million.

“The over $5 million tranche was a record high market share of 19.8 percent — so basically nearly one out of five sales in the Hamptons was $5 million or higher,” he said of the fourth quarter of 2023. “And the last time this set a record was about a year and a half ago when it was 12.9 percent. So it’s literally expanded by 50 percent.”

He said this led to a huge skew in the mix and a lot of distortion in the end-of-the-year numbers, though not enough to skew the numbers for the year as a whole.

In the $10 million and up range, there were 21 sales in the fourth quarter of 2023, compared to a recent norm of around 10 sales per fourth quarter.

“This is not evidence of a rapidly appreciating market,” Miller said. “This is evidence of a sharp shift in the product mix of what’s available, or what was actually purchased.

He also observed that the Manhattan market had a record market share of cash buyers, which he explained is significant because the Hamptons market is linked to Manhattan and Wall Street. He said the activity in the Hamptons and Manhattan high-end market indicates that those buyers are anticipating a change in the financial market related to the Federal Reserve’s moves. “It was almost a ‘go’ signal for the very top of the market — an unusual amount of high-end transaction volume,” he said.

Bourgard said buyers who had been waiting it out saw that prices were still on the rise, so they jumped in.

Inventory Woes

“You can’t sell what you don’t have,” Bourgard said, explaining why sales numbers are not as high as they could be.

Of the inventory that has come on the market of late, Miller is hearing that price is an issue.

“The feedback that I get from brokers on the ground, generally, is that the new product coming in seems to be priced on the high side, so the inventory quality isn’t necessarily as good as it could be,” he said.

At 1,026, the Hamptons inventory of single-family homes and condos is up 15 percent from a year prior.

“Even though it’s up 15 percent, it’s still 46.5 percent below prepandemic, meaning that inventory right now is half of what it was in the fourth quarter of ’19,” Miller said. “The high end is where you’ve seen the product expand significantly — but you’re still having bidding wars. So there has to be something wrong with the pricing of a lot of the product that’s come onto the market.

Bourgard sees the agents having a key role in bringing more inventory to market.

“We want them to contact all of their old customers,” he advised agents. “Let their customers know what these houses are worth in today’s market. The times of people holding on to houses for 30 years, that’s no longer the case. People hold on to houses now three, four or five years, and they sell and they move on. So many of the people really aren’t quite sure what their homes are worth, and it’s up to us as agents to reach out to everybody that we’ve sold a home to in the last 10 years and touch base with them. Because if you are the last point of contact with them, you’re the first person they’re going to think of when it comes time to sell their house.”

The high end has plenty of inventory to go around, though when priced unrealistically high, properties don’t meet the needs or expectations of high-end buyers who are waiting to find the right fit.

Miller notes that the top 10 percent of the market in the Hamptons has 50 percent of the supply. In the fourth quarter of 2023, the entry level to the top 10 percent of sales was $7.3 million — and more than half of the 1,026 listings available at the end of 2023 were priced at $7.3 million or higher.

It shows how detached the high end of the market is from the overall market, Miller said.

Good Signs and Great Investments

Bourgard said the fact that one in four Hamptons houses sold in the fourth quarter of 2023 was subject to a bidding war is one of the good signs for the market.

“Bidding war” means that a home sold for more than its asking price.

“We have so many more buyers than we do homes,” Bourgard said. “And these people want to be into these homes. And those are market values now. They’re willing to pay a strong market value to get into these homes.”

When rates fall, he anticipates more buyers will come off the bench and there will be even more bidding wars.

“Hamptons real estate has forever, historically, been a great investment for your money,” Bourgard emphasized. “That’s a fact.”

“Houses have always appreciated here,” said Ernie Cervi, Corcoran’s regional senior vice president for the East End.

Cervi observed that the agents with boots on the ground are already busier. He advised buying now to lock in the current price, gain the appreciation, and enjoy the property, and then refinance later after rates fall.

Old Numbers

Real estate sales statistics offer helpful metrics for understanding the market but can also lead to misconceptions about where things currently stand.

“No matter who’s doing your real estate report, it’s always the view in the rearview mirror,” Desiderio said.

She noted the time it takes between each of the steps from when a deal is struck to the sale being recorded at the county center: the offer and acceptance, going into contract, ordering titles and surveys, closing on the sale and the real estate attorney or title company recording the purchase.

Two to three months pass between the purchaser and seller making a deal and the sale being officially reported, and in some cases it can take several months longer.

Due to the time it takes to see market activity — or the lack thereof — reflected in quarterly reports, she expects the first quarter of 2024 report to show a slow market.

“This past winter that we’re in right now, this was a very soft market, one of the slowest that I’ve seen, and so that’s not really going to compute until Q1,” she said.

Affordability a Growing Issue

With housing inventory low and home prices higher than they were before the pandemic and holding strong if not rising, year-round residents who work in local school, business, government and health care positions are priced out of the market in most cases. The newly instituted Community Housing Fund — a 0.5 percent tax on home sales to fund affordable housing opportunities — is intended to change that, but it will take time for the CHF to rise to its full potential. In the meantime, housing challenges are creating staffing issues in vital roles for keeping the local economy, health care field and municipalities running.

“The municipalities now have to step up and provide a real master plan for workforce housing, affordable housing, and local housing,” Desiderio said.

She said that every time municipalities have changed zoning to lessen density it has squeezed out affordable housing.

“People want to have a starter house, and they should have a starter house,” she said. “But there’s no more inventory. There’s no more land that can be subdivided. That’s it. We're done. And we’re surrounded on three sides by water. So where are you going to go?”

She continued: “How do we provide for teachers and firemen and cops and doctors even? I’ve had doctors say to me, ‘I can't afford a house out here.’ That breaks my heart.”

High Hopes for the Rental Market

“This year’s going to be a banner year — huge,” Desiderio said of the 2024 Hamptons rental market.

Outside of the pandemic years, when everything rented or sold, or the Great Recession, when both rentals and sales paused, there is typically an inverse relationship between sales and rentals, she explained. She expects in 2024 that people who are hesitant to buy will readily rent.

“We’re coming off a very good year for Wall Street,” she said. “There’s a lot of money in the coffers, and the only wild card is, how secure do people feel with what’s going on geopolitically?”

People are ready to buy when they feel safe and secure and when their finances feel safe and secure, she said.

Cervi said Corcoran has seen a lot of seasonal rentals booked early this year. “We've done more rentals so far this year than we did last year. ... We are well ahead of where we were,” he said, attributing that to rental prices adjusting downward. “COVID pricing is over, and people aren’t looking for that, so these houses are renting.”

Also helpful is the amount of rental inventory that available — there’s a lot, even as sales inventory is tight.

“When the rentals are high the sales are usually lower, and vice versa,” he said.

Cervi also notes that renters usually come back and buy — and not necessarily the same house they had rented.