At a Southampton Village Board work session last week, Deputy Mayor Gina Arresta made a presentation that she said showed that, under the two previous administrations, the village had pierced a state-imposed cap on tax levy increases for eight consecutive years.

It was a claim that did not hold water.

The presentation, and that assertion, caused an outcry, and this week two former mayors insisted that the village has never pierced the cap — not once. If the village did indeed pierce the cap, it would be news not only to taxpayers but also to past Village Hall employees and the New York State comptroller.

Then-Governor Andrew Cuomo instituted the cap starting in 2012. Ostensibly a 2 percent cap on tax levy increases, the true limit varies based on inflation and on how much a municipality’s tax base has grown, and there are a number of exemptions that can come into play as well.

A village can exceed the cap if its board of trustees passes legislation authorizing itself to do so — and villages often pass that legislation as a precautionary measure — but in deference to taxpayers, they typically comply with the cap when the final budget is approved, and the measure is later rescinded.

“The Village of Southampton, under prior village boards, voted to pierce the tax cap every year, eight consecutive years, until 2021,” Arresta said during her presentation.

“This is bullshit, and you can quote me on that,” former Mayor Mark Epley said on Monday night. “They lied to the public. It’s an insult to everyone who served on the boards and worked in those administrations and put together those budgets.”

While it’s true that the Village Board adopted legislation annually to allow itself to exceed the cap, passing such a law does not necessarily mean that the board ultimately approved a tax levy that was above the limit. In fact, most, if not all, of those laws were repealed within a month or two.

Former village officials said that adopting the law annually is considered a budgeting best practice, just in case something unexpected happens — like state aid falling through — that could force a village to increase the tax levy more than it had planned to. The same officials said that the annual authorization never had to be used, because the village never pierced the cap in any of its final budgets.

Both Arresta and Village Administrator Charlene Kagel-Betts strongly asserted that the cap had indeed been pierced eight times, citing a report from the village’s new auditing firm, PKF O’Connor Davies. Kagel-Betts provided copies of local laws passed annually from 2012 through 2020, each permitting the Village Board to exceed the cap.

However, after The Southampton Press pointed out that Village Board minutes show those laws were later repealed in 2018, 2019 and 2020 — as far back as the minutes go on the village website — Kagel-Betts said she went back to the auditors.

“According to their audit — the actual tax levied by the village exceeded the allowable NYS Tax Levy Cap in multiple years from 2013-2019,” Kagel-Betts wrote in an email on Monday. “Now that it has been brought to our attention that some of the local laws have been rescinded, it appears the levy was exceeded unlawfully.

“Our auditors are now tasked to revisit their review and confirm that the resolutions repealing the local laws in certain years were appropriately filed with [the state],” she continued. “Then if needed, calculate the aggregate amount over the years that the tax levy unlawfully exceeded the [state] limit and determine next steps the village will need to take to correct the issue.”

Kagel-Betts followed up Tuesday with a new chart that says the cap was only pierced six times, and by much less money than Arresta’s presentation has shown.

“These numbers are very preliminary and need to be recalculated,” Kagel-Betts said of the updated chart.

On Wednesday, she attributed the differences between the chart presented to the public and the new chart provided to The Press to “a formula error in the original spreadsheet” prepared by a village accountant trainee.

“This chart may change again, as the auditors are now revisiting the Tax Cap testing, since some of the local laws have been repealed and that would be a concern,” Kagel-Betts added.

Mayor Jesse Warren declined to comment last week, referring all inquiries to Kagel-Betts, but in a text on Wednesday, he offered: “The numbers are directly pulled from our Village auditor and provided by out Village Treasurer so this is not a ‘he said, she said’ story.”

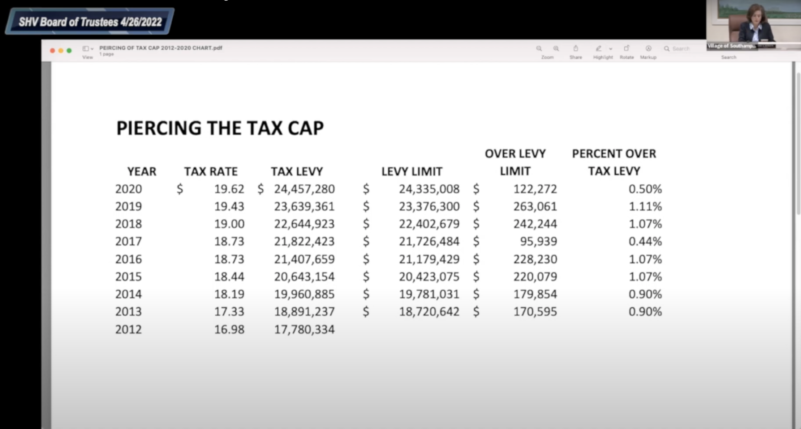

Arresta’s presentation included a chart titled “Piercing the Tax Cap,” and it showed the village as going over the state cap every fiscal year from 2012-13 through 2019-20, a period that spanned the administrations of both Epley and former Mayor Michael Irving. The amount of taxes levied “over the levy limit,” according to the chart, ranged from $95,939 in 2016-17 to $263,061 in 2018-19.

“The numbers don’t lie,” Arresta said during an interview this week, repeatedly.

However, the revised chart that Kagel-Betts provided tells a much different story than the one Arresta had presented to the public on April 26.

The original chart that Arresta asked to be put up on screen at the work session stated that the village exceeded the tax cap by $122,272, or 0.5 percent, in 2019-20. The new chart states the village actually was $150,517 under the cap that fiscal year — a $272,789 swing.

According to the new chart, that $150,517 was carried over to the next year and applied to tax cap calculation for Mayor Jesse Warren’s 2020-21 budget, his first after being elected for the first time in 2019. During that budget process, Warren voted in March for a law to authorize the village to exceed the cap and voted in May to repeal that authorization. In 2021 and 2022, the board never passed such a law.

For 2016-17, the swing between the original presentation and the new chart was $237,308, from $95,939 over to $141,369 under.

For the fiscal years that ended in 2013, 2015, 2018 and 2019, Arresta’s presentation alleged the cap had been exceeded each year by an amount in the low six figures. The new chart says the excess in each of those years was actually in the four-figure range — $9,270 at most. The biggest excesses are now reported as $28,565.75 in 2015-16 and $171,117.60 in 2013-14. Arresta’s presentation had pegged the excesses those years as $228,230 and $179,854, respectively.

The new chart also states that there were four years when the village both pierced the cap and repealed the law authorizing it to do so.

If that proves to be the case, it’s a problem. According to a former village official who is familiar with the state’s tax cap law, who spoke on condition of anonymity, if a village does not have an authorizing law but pierces the cap anyway, the money in excess of the cap must be set aside and can only be spent after a public hearing is held.

If the cap was, in fact, pierced six times, including four times without the authorizing law in place, as today’s village officials now say, it went unnoticed by external auditors, the state comptroller’s office and various village officials from different administrations for years.

PKF O’Connor Davies did not immediately return a message Tuesday requesting comment.

Irving, who served one mayoral term from 2018 to 2020 and served as a trustee before that, and Epley, who served six two-year terms as mayor before Irving, both adamantly rejected the claim that the village pierced the cap during any year during their tenures.

“I don’t really understand why this is coming out now, other than that it’s a political maneuver,” Irving said Wednesday morning. He added that all the village financials in previous years had been audited. “You would think that, along the way, if there were any mistakes made that they would have been picked up on,” he said.

Irving said the village worked “very diligently” specifically in 2016, 2017 and 2018 to make sure the village’s financial position was very strong, because they were trying to increase the bond rating — which he said they did, to AAA, the top rating.

“I find their comments a little out of line,” he said. “Obviously there’s always a chance of a mistake being made, but I find it unlikely.”